Welcome, it’s great to have you back! If you aren’t a subscriber yet and enjoy the content I post, feel free to subscribe and you won’t miss any new content.

Today I will present you my deep dive on my favorite small-cap company: Nordic Unmanned.

Introduction

Nordic Unmanned (“NU”) was founded in Norway in 2014 with the vision to transform the offshore oil/gas industry the same way subsea ROVs (remotely operated underwater vehicles) transformed the industry but this time by air and much faster, safer, and cheaper for clients. In 2014, drones were only used for military operations and NU saw the opportunity to provide affordable drone solutions to the industry. NU took many years and high losses until they achieved the breakthrough in 2020 with doubled revenue and becoming profitable.

They entered 2020 as an unprofitable start-up with a vision to transform transportation and finished 2020 as a profitable and public company with a large backlog of long-term contracts that ensure revenue streams. Long-term contracts set the cornerstones for future growth and provide security for the upcoming years.

Drone market

Over the next 4 years, the European drone market is expected to double and the growth rates in other regions are similar.

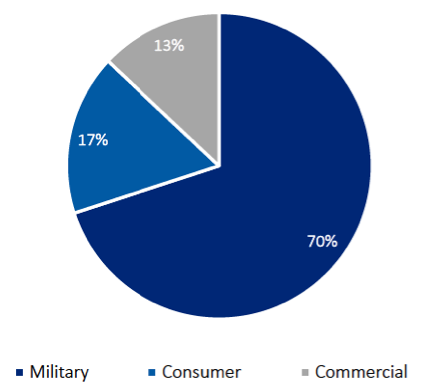

Drones have been used in the military sector for the longest time and 70% of the global revenue in the drone market is generated with military operations. However, commercial usages are expected to grow quickly and make up for the biggest share of revenue over the next couple of years.

Business operations

NU splits up their operations into four different sectors:

Green Solutions

NU sells solutions for minimizing maritime pollutions to governments which include emission monitoring of vessels and emergency solutions for oil spill monitoring.

Defense & Security

NU also provides tactical drone solutions to military and police operators in Europe.

Digitalization

Data is the most important resource in almost every industry and the survey and mapping solutions provide NU’s clients with detailed real-time data about the flights and everything that is surveyed.

Logistics & Robotization

Fully automated drone flights are the safest way for transportation as no humans are interacting and in a position where they could make mistakes.

Furthermore, when comparing the CO2 emissions of the NU drones to the traditional helicopters the advantages of NU become very clear. The Camcopter of NU emits 98% less CO2 compared to the Sikorsky S-92 helicopter used regularly in North Sea offshore operations.

Additionally to being safer and beneficial for the environment, drone flights with NU are also about 30-40% cheaper than helicopters. In the long run, I’m predicting drones to replace helicopters in almost all industries. NU is in a prime position to benefit from that trend.

CEO / Management

NU is founder-led by Knut Roar who is also the biggest shareholder in the company (skin in the game). The whole management team consists of experienced professionals that had leading positions in the aviation/logistics or oil and gas industry and their execution has shown that they are excellent.

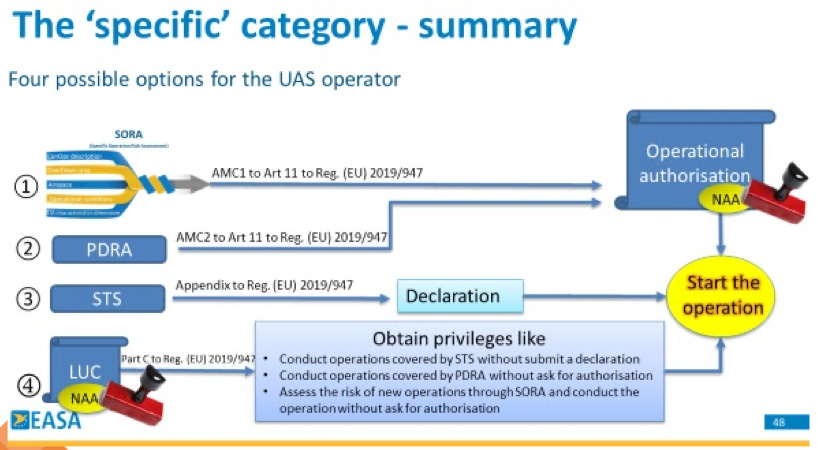

Light Unmanned Operator Certificate

NU was granted the LUC starting from the 1st of January 2021. Before receiving the certificate, NU was able to operate in 13+ countries but now with the LUC, NU can fly in all EU countries which provides great potential for future growth inside Europe.

The effect of being granted the LUC can be seen in the flying activity in the first half of 2021. Once NU can establish themselves in the countries they are now starting to operate, I expect future growth to further accelerate.

Flying activity in the first half of 2021

Corresponding to the increase in revenue, the number of flights increased significantly as well to 545 flights in Q2 of 2021 (156 in Q2 2020). The flight hours in the first half of 2021 increased by 240%. However, NU was not able to significantly increase the price per flight hour which is something I will keep monitoring over the next quarters.

Long term contracts and backlog

One of the big advantages of NU is long-term contracts that provide security and funding of new investments to further increase growth. Once NU was able to secure a long-term contract with an important business partner, it also opens the opportunity to develop a long-term partnership with the clients. One of the most important contract opportunities for the upcoming years in the Defence & Security sector can be found below.

The backlog as per Q2 of 2021 amounts up to NOK 364 million and increased by NOK 81 million during the second quarter. Keep in mind, that the backlog only represents guaranteed revenue from current contracts. There will be new contracts signed over the next few years which will further increase the backlog which already amounts up to 5.5x the entire FY2020 revenue.

NU targets revenue to be NOK 4 billion by 2025 which is 4.5x their current market cap! Although this is optimistic, I can see a scenario where this is happening.

Recent events

The second quarter of NU was very busy. NU was able to sign contracts in Dubai and Brazil which further enhances the global growth of NU. This is important since once NU is able to get their first contracts in a new market, they are able to sign more contracts in that region as they have better knowledge of the market and the competitors.

Just last month (July 2021), NU signed the agreement to acquire AirRobot for € 5 million. AirRobot is the leading German drone supplier and provides the German armed forces with drone solutions. The acquisition makes a lot of sense and AirRobot fits in perfectly in the NU Group. Closing of the transaction is expected to happen in Q4 of 2021.

NU developed a solution for the Lockheed Martin Indago to detect radioactive substances. They integrated the detector in the drone, developed the software, and connected everything with the live data generated by all their drones. NU now offers the service to their clients.

Financials

9.1 - Recent earnings

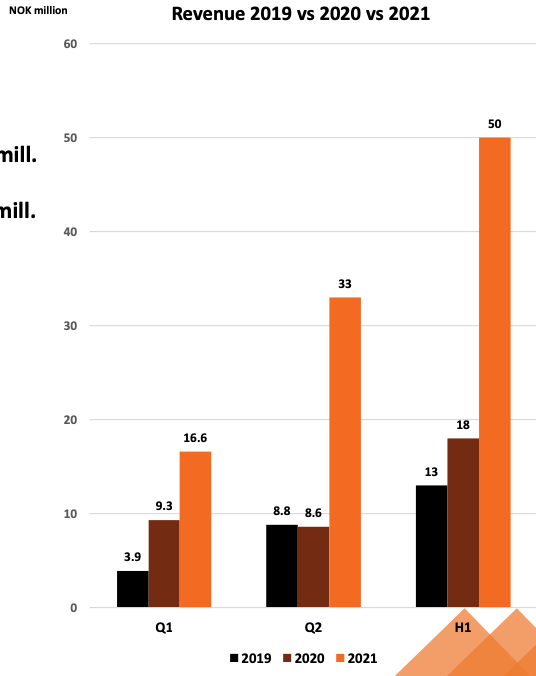

Nordic Unmanned was able to increase revenue in the second quarter by almost 300% compared to the second quarter of 2020. The entire FY2020 revenue has already been exceeded in August 2021.

95% of the entire revenue is still generated in Europe which enhances the importance of new contracts outside of Europe like the ones signed in the second quarter this year in Dubai and Brazil. It can also be seen as an opportunity for NU because revenue will drastically increase once they are able to disrupt the US market. NU’s main market has been Europe but they plan to expand their operations to the US market in 2021/2022. This is the classic strategy that you see from most companies coming from Europe: They start as a start-up in their home market and once they are able to provide a scalable service/product they expand in bigger markets and significantly increase revenue and profits in bigger markets.

NU was EBITDA profitable in Q2 as well which is important for small-cap companies like NU because it provides a little bit more security.

9.2 - Valuation

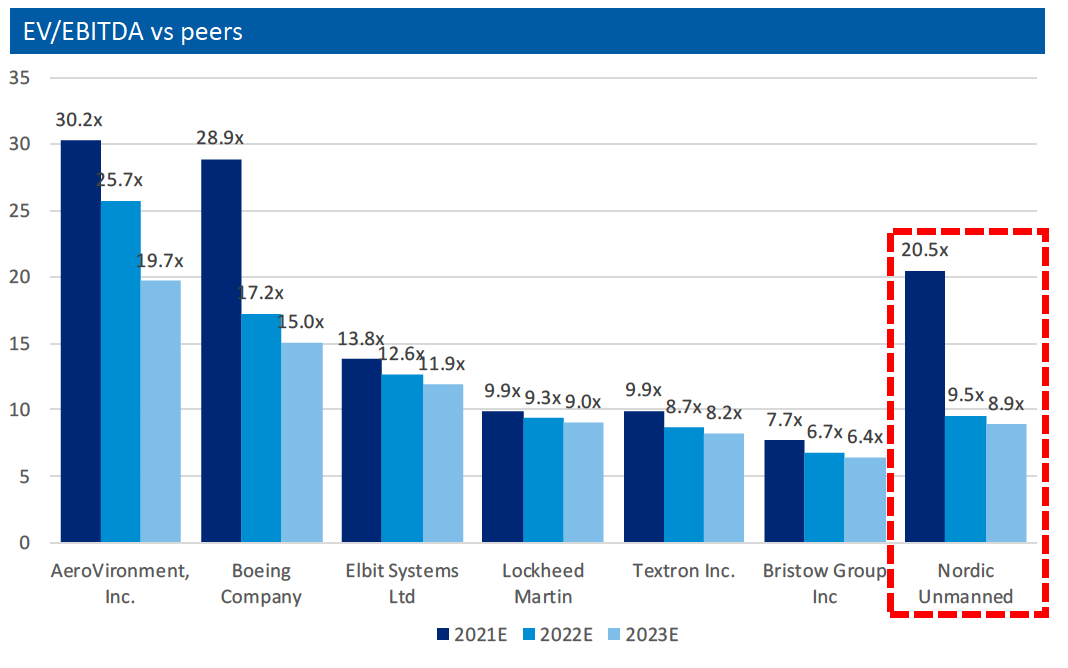

When looking at EV/EBITDA, NU is valued in line with the industry average but growing way faster than peers like Boeing or Lockheed Martin.

Risks

It’s important to keep in mind, that NU is still at a very early stage and basically still a start-up. Although they are now profitable, there is no guarantee that they will still exist in ten years. When investing in small-cap companies, position-sizing becomes very important. Long-term contracts minimize risks as at least short-term funding is guaranteed but there can still be a competitor with cheaper solutions that will get all the new contracts. The dependency on the European market can be seen as a risk or an opportunity depending on the personal opinion.

Summary / own opinion

Since NU is a top 5 position in my portfolio despite the low market cap of $100 million and the risks coming with investing in early-stage companies, I’m obviously very bullish on the company. Especially the long-term contracts and the impressive backlog result in one of the best risk/upside opportunities in the market. The drones provide real value to NU’s clients and I expect drones to replace helicopters in almost every industry. If the upside outweighs the risks is your decision though. 😉

I hope you enjoyed the deep dive and feel free to share and subscribe if you did. Have a great week and see you soon! All the best, Alessandro.