Welcome, it is great to have you back! If you are not a subscriber yet and enjoy the content I post, feel free to subscribe and you will not miss any new content.

Table of Contents

Introduction

Vision

Mission

Strategy

Management

Product

USP

Business Model

Use case Florida

Path to commercialisation

Risks

Financials

Conclusion/Own thoughts

1. Introduction

Manhattan to JFK Airport in 5min? New York to Boston in 1h 15min? And all that with zero emissions and at an affordable price? Let me tell you how Lilium wants to transform transportation: My first encounter with Lilium was when I was in high school doing a presentation on mobility. Back then they were a small start-up located in Southern Germany with a few excellent engineers and a crazy vision. Well, four years later they are a publicly listed company at the Nasdaq and keep on pursuing their vision.

2. Vision

Lilium’s vision is to create a new way of affordable and regional transportation that is faster than traditional transportation and produces fewer emissions.

3. Mission

The mission which can be derived from the vision is to combine German engineering with Silicon Valley management. This combination makes Lilium competitive and truly unique for a start-up/early-stage company.

4. Strategy

To achieve their very ambitious vision, a well-thought-through strategy is essential. Like most tech companies Lilium has a great product with extremely complex technology behind it. When comparing the total number of employees (~700) to the number of aerospace engineers (~400) it becomes clear how big of a focus they put on their technology department. Additionally, they focus on customer experience which they think is essential to achieve customer retention.

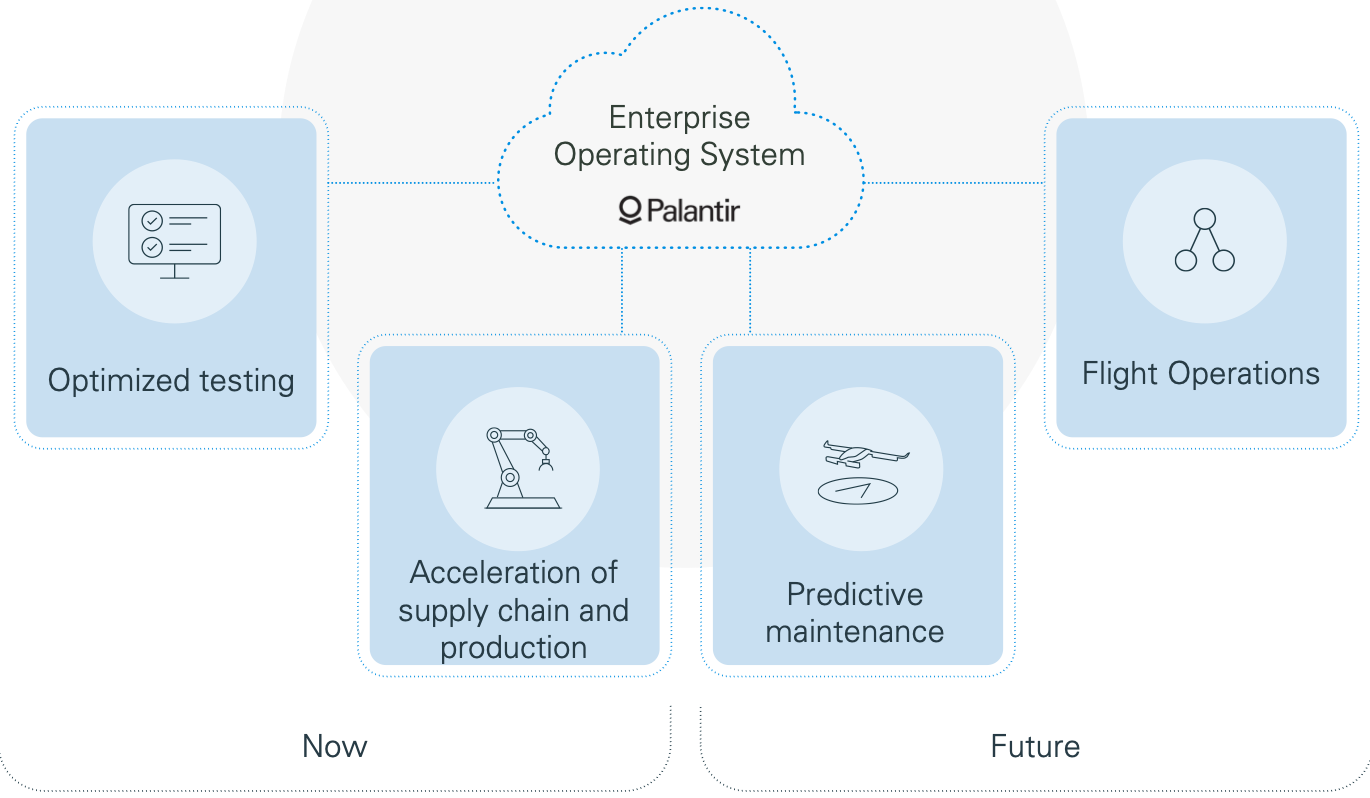

Lilium understands that strategic partnerships are key to a successful company and subsequently made the decision to partner with innovative companies like Palantir. This specific partnership focuses on analytics for testing and the supply chain. Use cases are predicting future maintenances and the optimization of the supply chain. Lilium stated in their latest shareholder letter (Nov. 16, 2021) that Palantir’s software Foundry is already improving flight testing campaigns which is great to see. Furthermore, Palantir is a PIPE investor and looking forward to further supporting Lilium.

Flight testing campaigns are key to Lilium’s strategy and they plan to expand their testing campaigns to Spain next year to see how different weather conditions affect the jet. The flight permission for Spain is expected to be granted in the first half of 2022.

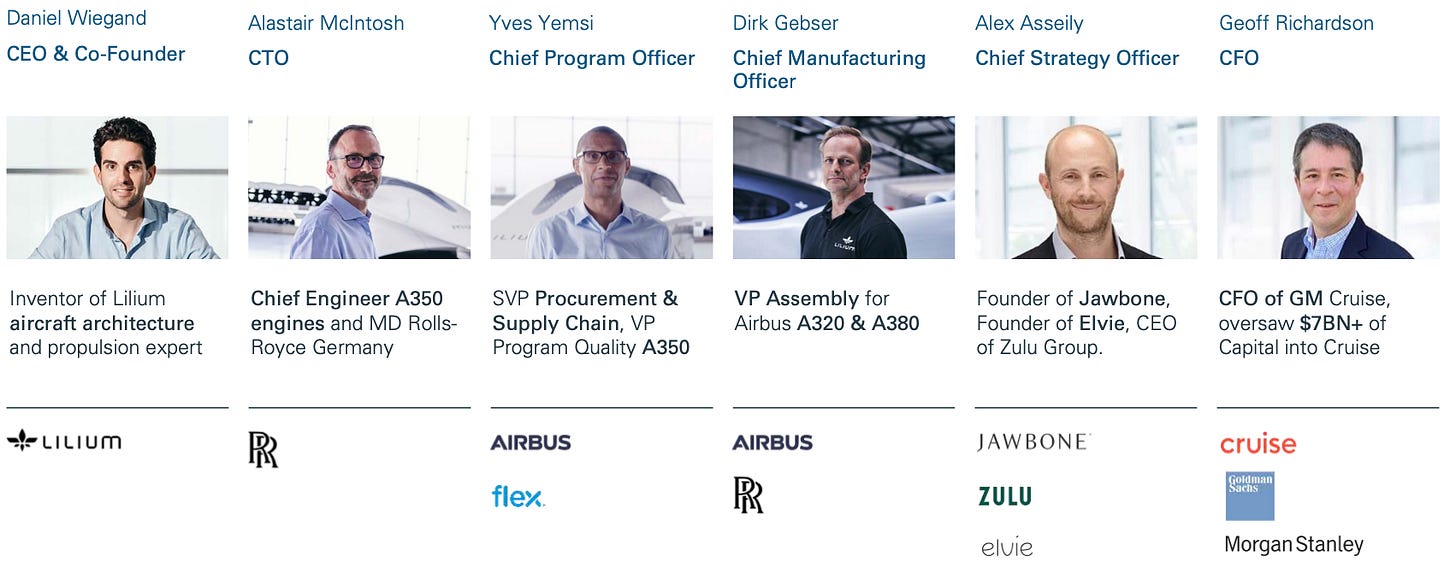

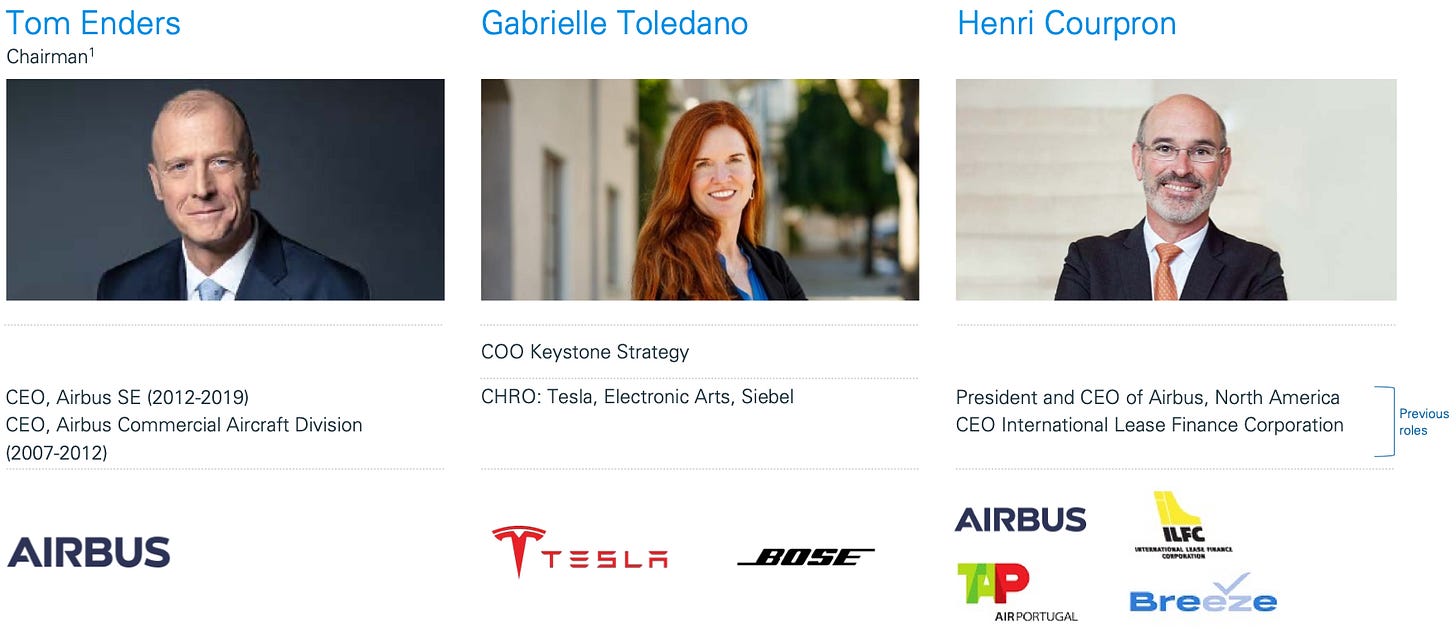

5. Management

The management team of Lilium consists of high-level executives from Airbus, Rolls-Royce, Morgan Stanley, and other world-class companies. Additionally, the company is led by its founder Daniel Wiegand, who is an aerospace engineer himself. A qualified and capable board of directors is key to a company’s success: The latest additions are Tom Enders (former CEO of Airbus and now Chairman of the Board of Lilium), Gabrielle Toledano (former CHRO at Tesla, Bose, and Electronic Arts) and Henri Courpron (former President and CEO of Airbus North America).

6. Product

The aerospace industry is driven by technological innovation and Lilium is a great example of what happens when 400+ top-notch aerospace engineers work on a single product. Lilium spend years developing an eVTOL (electric vertical take-off and landing) jet and the result is phenomenal: a fully electric jet that can travel at 175 mph with a range of over 150 miles. Additionally, it can take off and land vertically, so it can easily fly directly from city to city without needing huge airports. The jet has a capacity for up to seven people and the luxury and spacious design provides a comfortable experience. Furthermore, the long-term goal is to get the jet to fly fully autonomous which will account for a safe flight and no room for human errors. Lilium has similar safety standards to Airbus with the additional risk of human influence taken out. However, it will not be easy for Lilium to get permission for fully autonomous flights. Until that permission is granted, a pilot has to be on every flight which is an additional cost factor. Lilium already agreed with Lufthansa on an agreement to get extensive training for the Lilium pilots.

7. USP

Ecological benefits

Maybe the most important question investors should ask themselves when looking at a company is: What makes this company better than its competitors and why should their product be used? When looking at end-to-end CO2 footprints from different transportation alternatives the advantage of Lilium becomes very clear:

PKM stands for emissions per passenger kilometer traveled and the Lilium jet is superior to not only planes or gasoline cars but also electric cars and trains. One could think that transportation is not that big of a deal for stopping climate change but transportation accounts for almost 30% of US and EU GHG emissions. Climate change will not suddenly disappear and companies providing real value in this space will benefit from the need for ecological solutions.

The difference can also be seen when comparing Lilium jets to helicopters since they account for significantly fewer emissions and costs of operating.

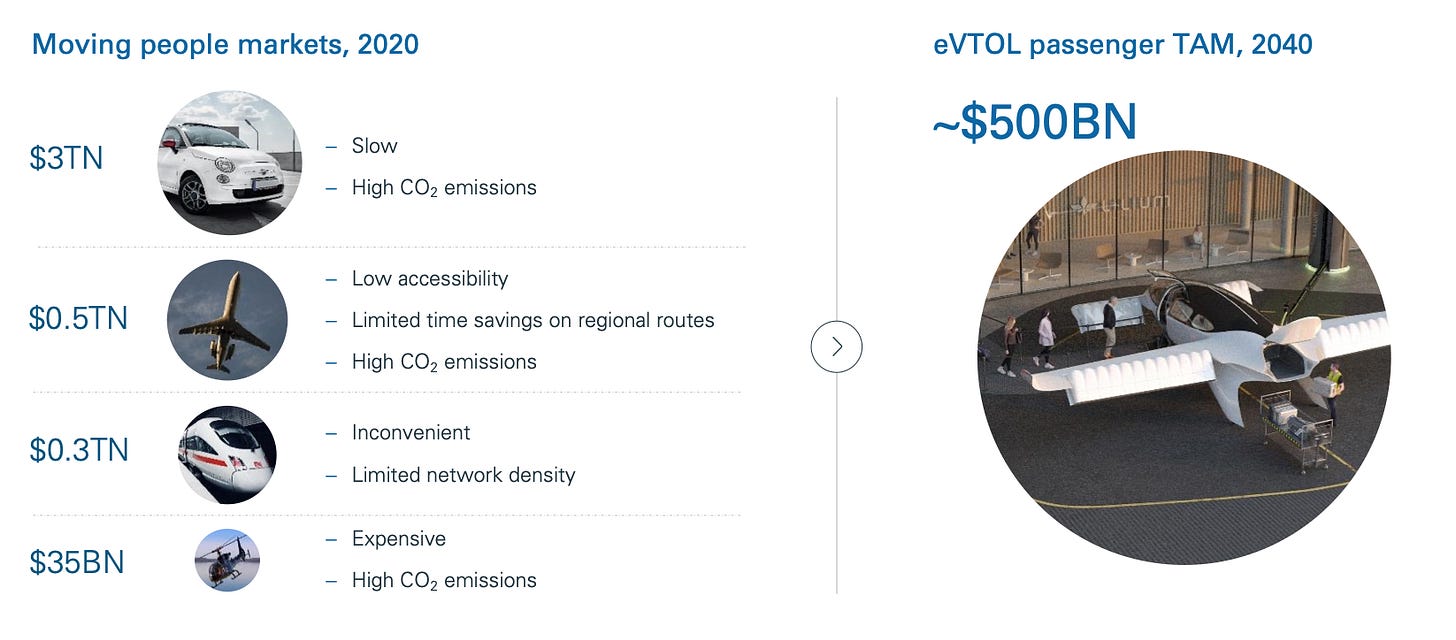

When comparing eVTOLs to other transportation modes you are basically replacing helicopters with a cheaper, faster, safer, and ecologically friendlier product that could also eat the market share of trains, planes, and cars as they are inferior in many ways as well. Even Elon Musk said in October 2021: “I’m so dying to do a supersonic, electric VOTL jet, but adding more work will make my brain explode.” The importance of the eVTOL markets becomes more and more clear and Lilium is in a prime position to benefit from that:

Differences to other eVTOLs

Every other eVTOL jet I have come across has rotating blades instead of ducted fans as their choice of propulsion. However, Lilium is different: 36 integrated ducted fans that can be adjusted accordingly to flying direction instead of rotating blades. This accounts for more safety and many other benefits I want to elaborate on now.

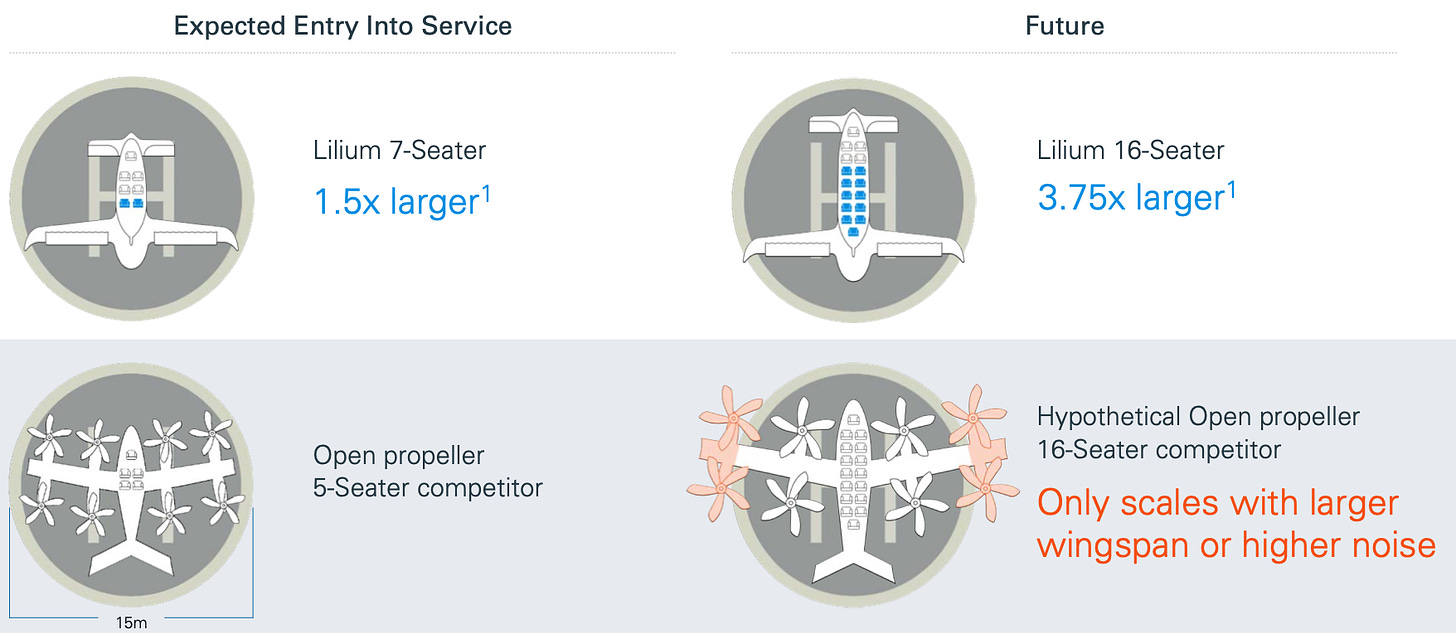

The ducted fans are way smaller which means it is easier to scale capacities in the future as competitors will need significantly larger wings to fit in more or bigger propellers.

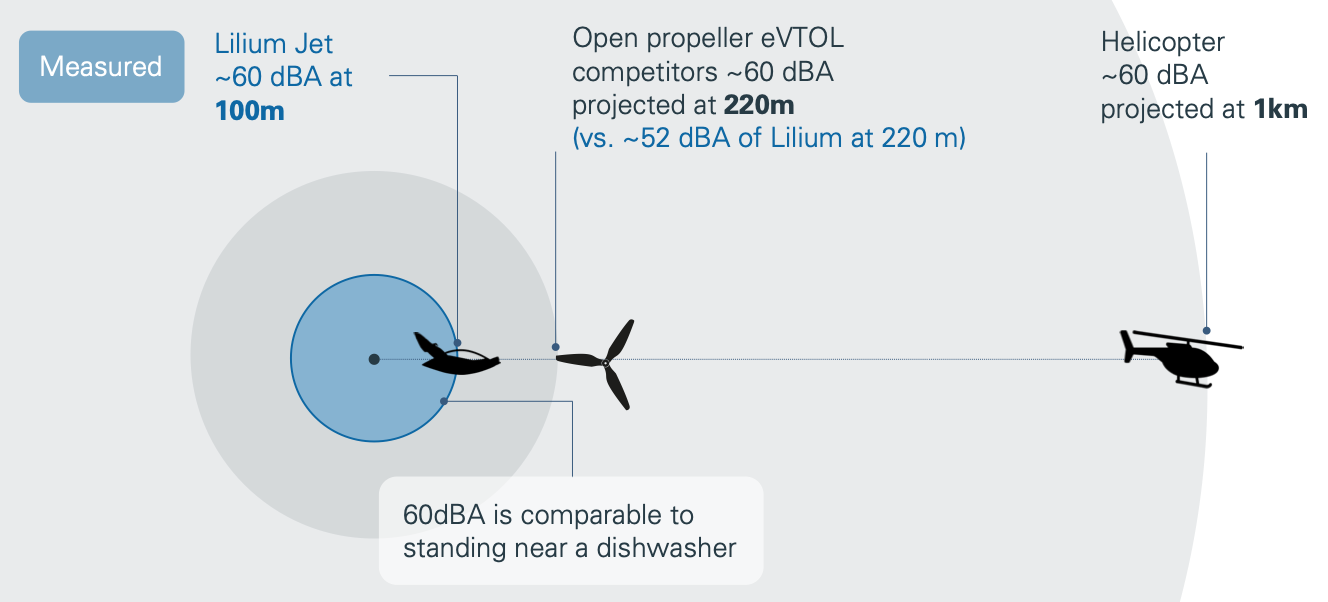

They could also make them spin faster but that would lead to a significant increase of noise and the competing jets are already twice as loud as the Lilium jet and helicopters are 10x the noise.

8. Business Model

The business model of Lilium can be split up into two main parts: Lilium Network (B2C) and Turnkey Enterprise Sales (B2B). Additionally, we will take a look at another possible use case in cargo transportation.

Lilium Network (B2C)

The B2C business incorporates Lilium selling tickets to customers and their passenger network. The business is called Lilium Network because Lilium focuses on building a strong brand that accounts for a great overall experience. These types of experiences further amplify their focus on networking as their customers are more likely to tell their friends and colleagues about their experiences. Lilium will start operating its B2C network in the US and Europe before expanding globally.

Turnkey Enterprise Sales (B2B)

The B2B business consists of selling aircraft fleets to corporates and governments which enables them to make even more money by providing maintenance and support services.

They already achieved a preliminary binding agreement regarding a deal with Azul (largest airline network in Brazil) over the sale of 220 aircrafts (deal worth $1bn). Sao Paolo is the biggest helicopter market in the world and Brazil is the second biggest business aircraft market in the world. However, Brazil is not the type of market Lilium wanted to start operations in at such an early stage as they are focusing on the US and Europe so ultimately the partnership with Azul makes perfect sense as they know the LATAM market better than anyone else. Azul is helping with regulations and relationships with local regulators and can provide real value to this partnership. The safety of Lilium jets was critical to the decision of buying 220 jets according to the company and Tom Enders (former CEO of Airbus and Chairman of Lilium) has connections to every major aerospace company in the world and made the deal with Azul happen. This once again shows the value of a top-notch management team and board.

The B2B business is not limited to the US and Europe which the B2C business will be at the start but global deals in interesting markets can happen like we already saw with Azul.

Cargo deliveries

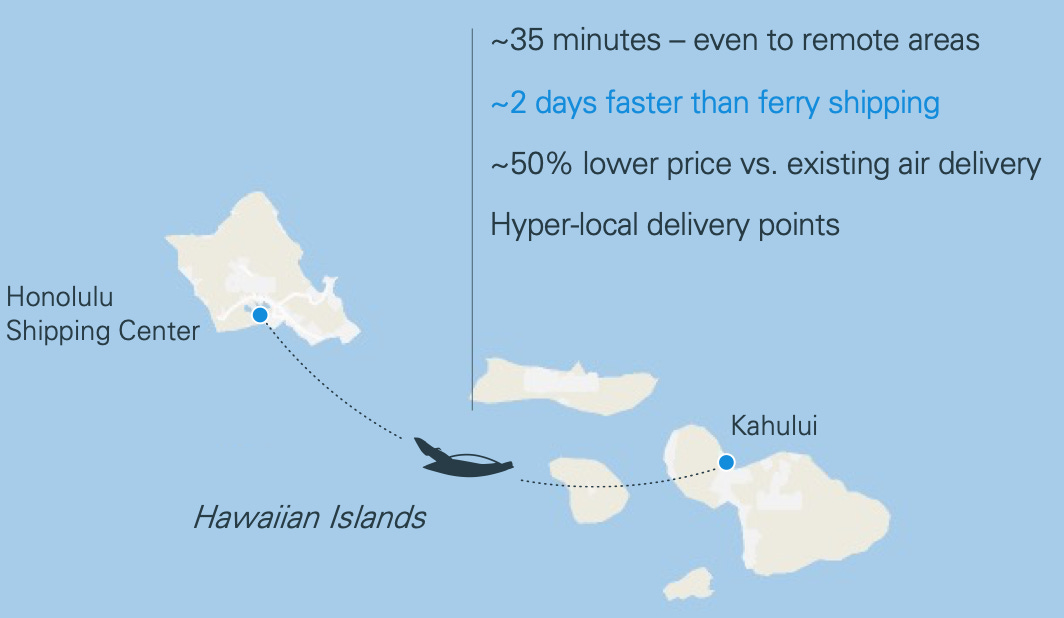

Possible use cases for cargo deliveries are between islands and spots that are difficult to reach with regular transportation:

Customers usually want their bought product on the same day and Lilium makes it work. Many companies are struggling with logistics and Lilium brings a certain amount of flexibility to this market. A Lilium jet covers 25x the service area as a truck in a specific time frame and is more flexible than planes or trains.

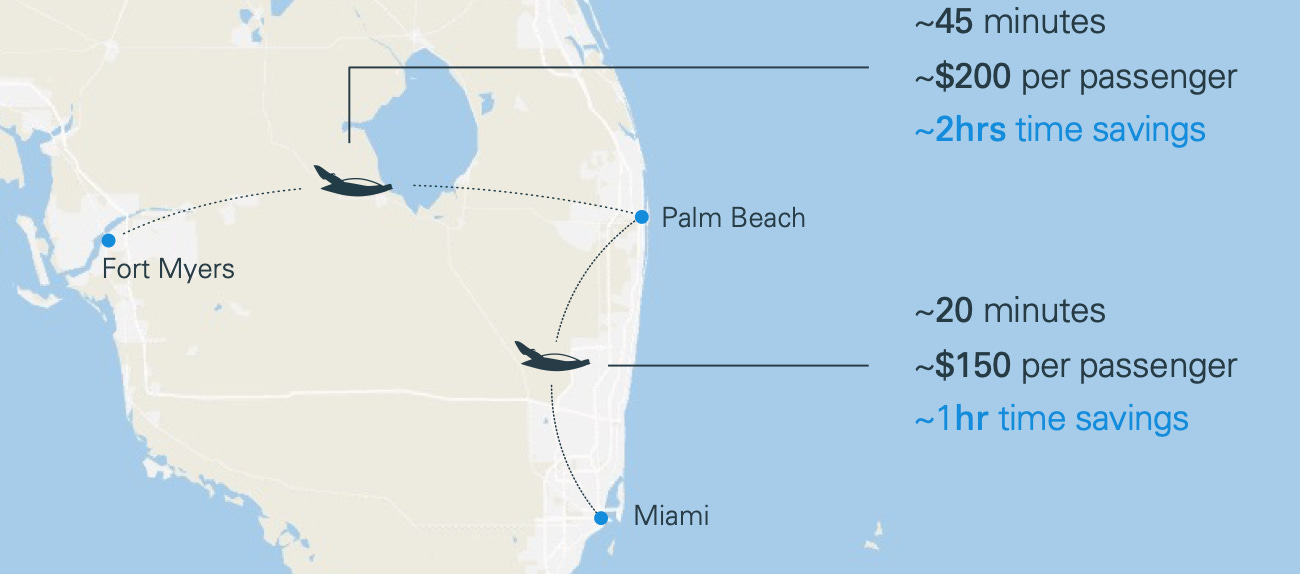

9. Use case Florida

Status quo

Florida has the 4th largest US GDP and around 130m tourists per year. There is almost no high-speed transportation between cities in the state and people travel between cities a lot. This leads to 90% of commuters traveling by car because there is no alternative. Lilium wants to create an affordable alternative for high-speed transportation which makes trips across the state in 45min possible.

Partnership with Ferrovial

Lilium has already signed a strategic partnership with Ferrovial (operator and transport infrastructure developer) that operates 33 airports including London Heathrow. The partnership includes an investment of Ferrovial of $200m to build up infrastructure and they will operate the system exclusively for Lilium:

In the recent investors call on Nov. 16th it was stated that the Palm Beach International Airport permitted the first Vertiport for the exclusive usage of Lilium. The partnership with Ferrovial was expanded as well with now access to 25 Vertiports in the UK and 20 in Spain. The Vertiports are designed for the Lilium jet and customers. This shows that the business relationship seems to work very well and it will be interesting to see further developments.

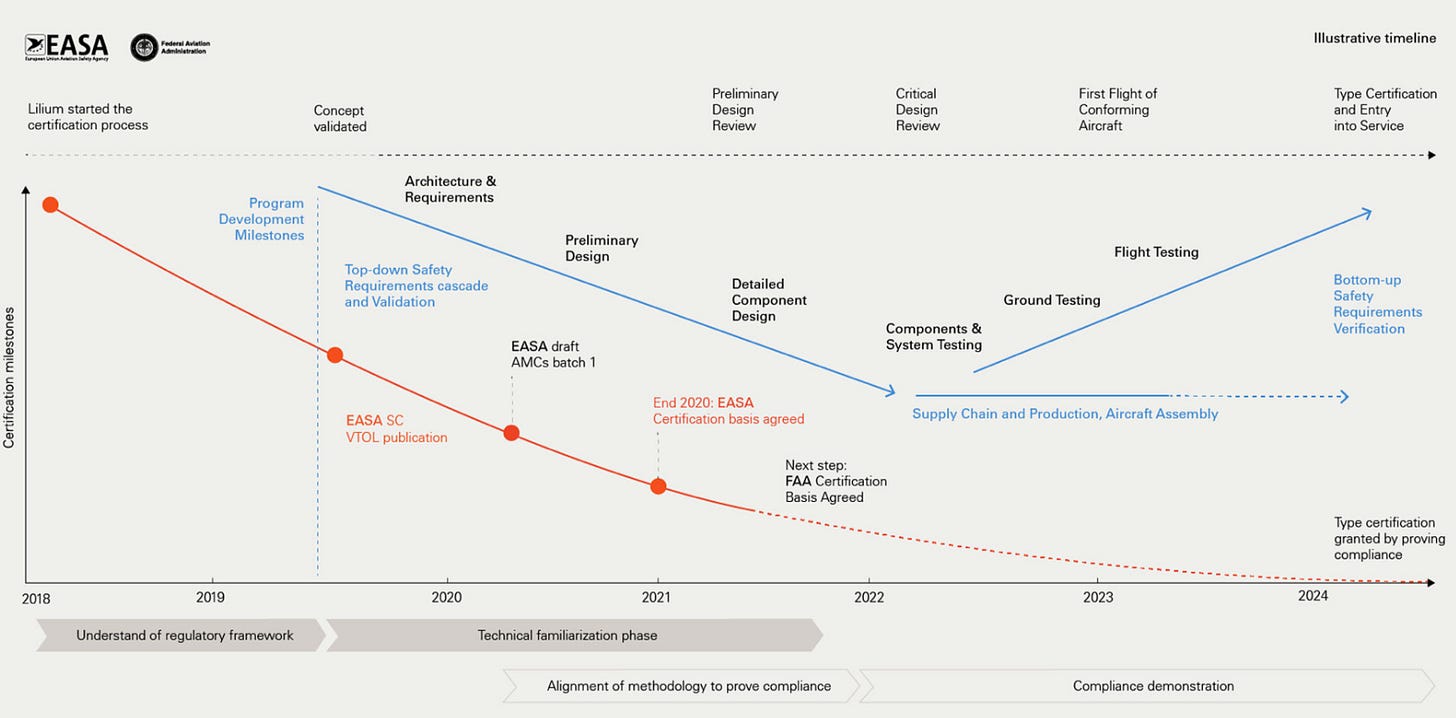

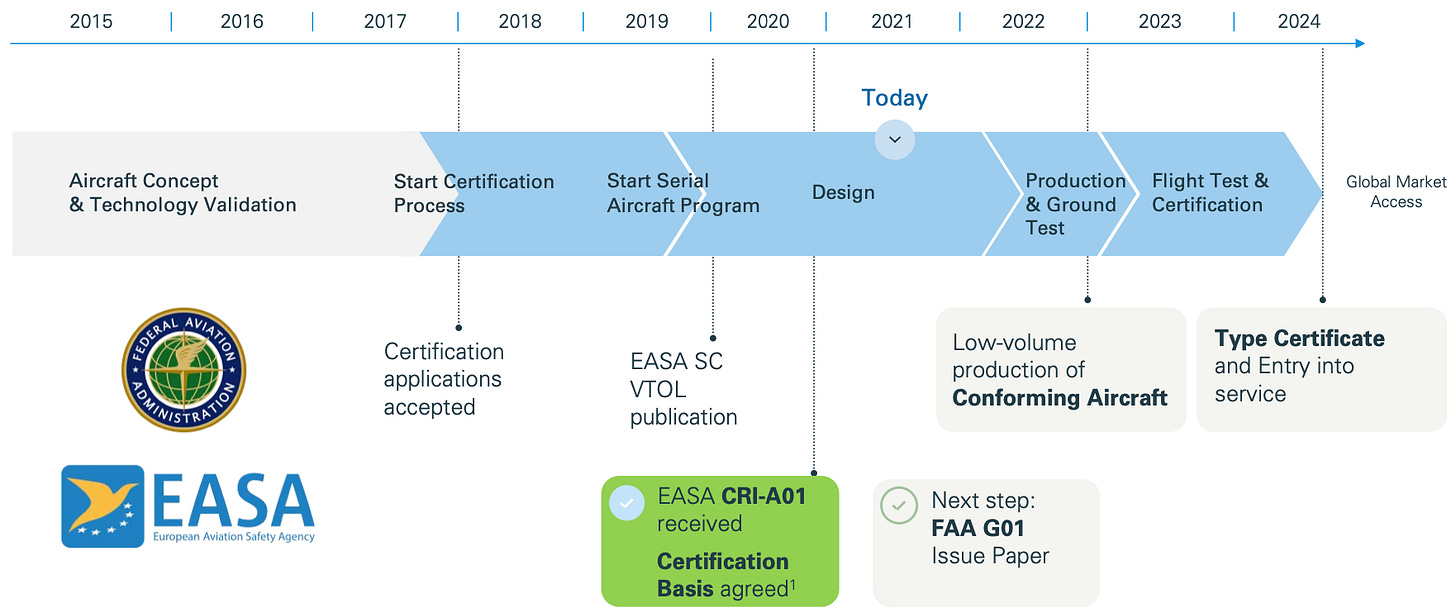

10. Path to commercialisation

The upcoming phases can be split up into:

1) Preliminary Design Review (PDR)

2) Critical Design Review (CDR)

3) Production Start

4) Ground Test Campaign & First Flight of a Conforming Aircraft

5) Type Certificate & Entry into Service (EIS)

1) Preliminary Design Review (PDR)

Lilium entered this stage earlier this month (Nov. 2021) and the key parts of this stage are to make sure that the jet meets all the airworthiness requirements, can perform like assumed in the business case, and can be manufactured in the required quality. Once Lilium completes PDR, there will be further contracting activities with suppliers and even higher financial commitments to existing suppliers.

2) Critical Design Review (CDR)

CDR represents the final design stage. At this stage, the most important technical trade-off decisions are made and the design is getting finalized.

During that process a bottom-up approach is going to be used, meaning that the individual parts will need to pass CDR first and since they have to complement each other and work together they need to pass CDR at the aircraft level as well. After that stage is finished, production can begin.

One thing to keep in mind is that innovation within the different components of the aircraft is constantly happening and regarding that issue, the CTO stated on the latest investors call that Lilium will try to implement new technologies as soon as they are available.

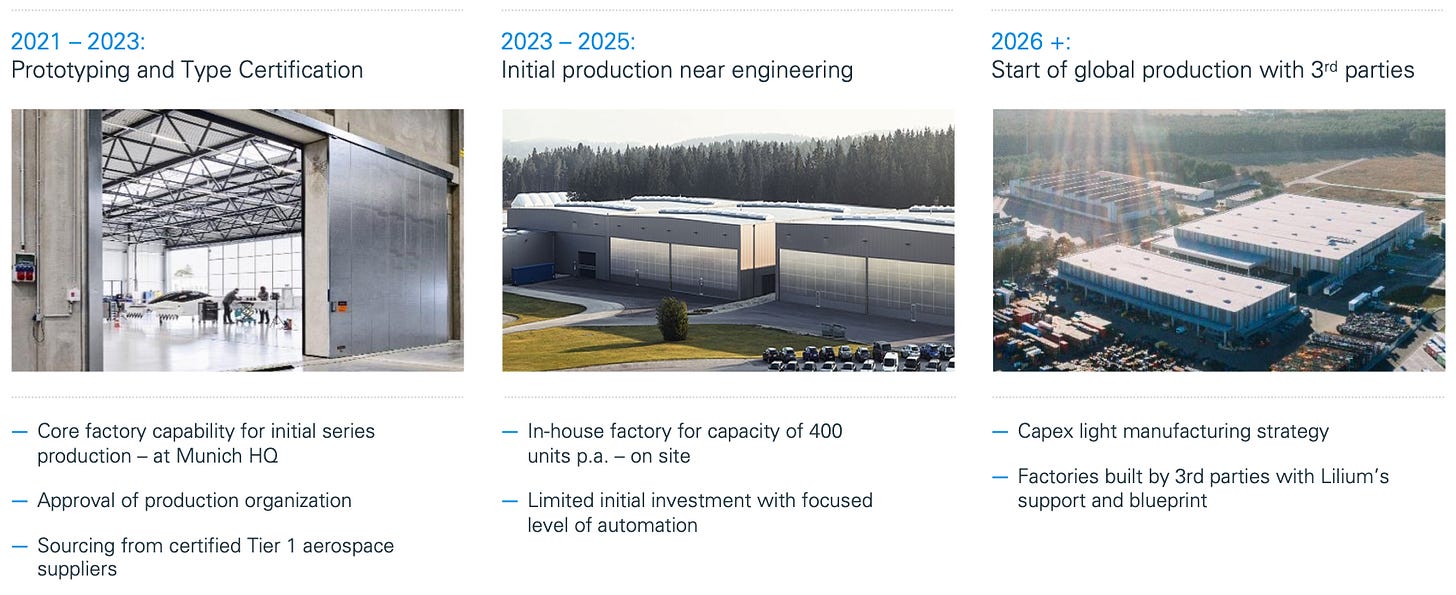

3) Production Start

Once the design of every component is locked in, the first production series can begin. The manufacturing strategy will be key to the success of this particular phase. Initial production will be at the headquarters in Munich for the first 400 units. The money raised through going public will be used for building the factory for the starting batch. Global production with 3rd parties is expected to happen by 2026 to really upscale the production process.

Battery capacities are secured with CUSTOMCELLS until at least 2026 to secure the launch of Lilium jets. Porsche AG started a joint venture with CUSTOMCELLS as well and works together closely to improve the quality of batteries. The current chip shortage shows the importance of securing these types of essential supply capacities. The first CUSTOMCELLS batteries are expected to arrive at Lilium next year.

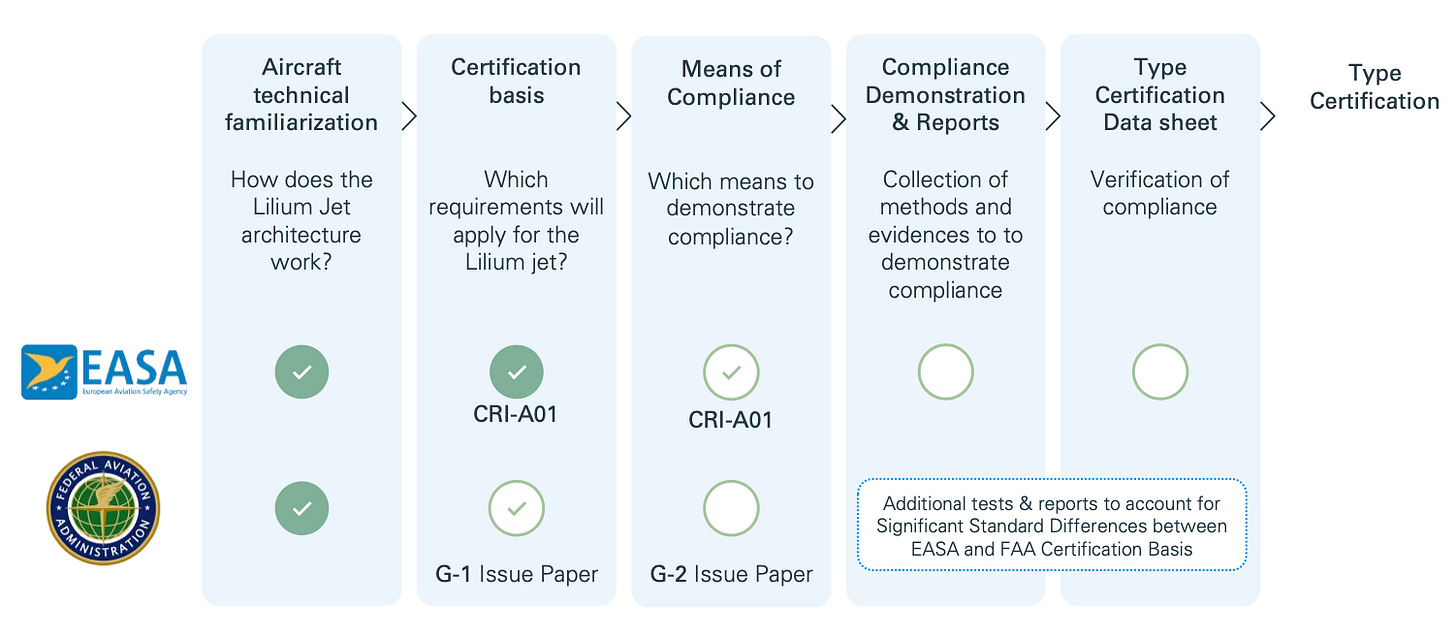

4) Ground Test Campaign & First Flight of a Conforming Aircraft

The Ground Test Campaign is the final stage towards getting the EASA (Europe) and FAA (US) certification. For this stage, a Conforming Aircraft is needed which will be similar to the technology demonstrator but it also has to fulfill all the requirements set by the corresponding regulators. There will not be one specific Conforming Aircraft but rather various aircrafts with different configurations and there will be many flight tests performed simultaneously.

Lilium works with EASA to ensure that the Conforming Aircrafts will meet these requirements. One of the key milestones was agreeing on the Certification Basis in 2020 which makes Lilium one of only a handful of companies achieving this milestone.

The data collected through the flight testing will then be analyzed by the regulator and the decision whether certification will be granted will be made.

5) Type Certificate and Entry into Service (EIS)

After being granted the certificate, Lilium will still need extensive crew training to ensure airworthiness. The Lilium jet will be operated through a fully-fledged airline with an Air Operator Certificate (AOC). However, the jet will still be labeled Lilium and Lilium is responsible for selling the tickets as well. Since the planned operations are similar to existing services, operating rules already exist and Lilium expects to be granted the AOC without any problems.

Type Certification is the ultimate goal and finish line for the path to commercialization. After being granted the Type Certificate by the EASA and FAA, Lilium will be able to start commercial operations in their desired markets at launch.

Working with the EASA and FAA on the corresponding flight permissions, helped Lilium in engagements with the ANAC (Agência Nacional de Aviação Civil) which is responsible for granting the flight permissions in Brazil. The plan is to add the Lilium onto an Azul Air Operator Certificate (AOC) and Lilium is working with Azul and ANAC to make that happen.

However, innovation does not stop and the jet will most likely experience further adjustments, developments, and improvements even beyond Type Certification.

11. Risks

Certifications

Although Lilium has a clear plan to get the required certifications, it is not guaranteed that they will get the certifications. Without Lilium getting the certification, the business model, management, and product will all be irrelevant as the jet is not allowed to fly. However, since Lilium is working with the regulators I expect Lilium to adapt to the requirements and make sure to get the certifications. The question is probably rather when that is going to happen than if it is going to happen.

Feedback from customers

The product and customer experience look amazing on paper but it is impossible to safely predict the customer feedback before commercial launch. As the main focus of Lilium is to provide a great customer experience, I expect it to be exceptional and I do not think this risk is as significant as other risks.

Big aerospace company launching a competing service

Considering the time and expertise that Lilium invested over the last couple of years it is hard for me to imagine that another company could catch up and launch a competing service in time. However, it is not impossible and should be considered.

Manufacturing risks

Lilium does not yet have manufacturing capacities for the expected number of jets Lilium wants to build and the costs of setting up the needed infrastructure remain to be seen. Lilium has a plan for setting up the infrastructure but nevertheless, this risk remains relevant in my opinion.

Supply chain issues

Lilium stated in their latest shareholder letter that supply chain disruptions due to the COVID-19 pandemic could be responsible for an increase in unit costs in the future. I have been in contact with IR regarding this issue and they clarified that their projection for unit costs was obtained before experiencing COVID disruption and the inflationary environment. If the supply chain issues do not get solved quickly it could negatively influence margins in the future.

Financial risks

Especially the pricing power of Lilium remains to be seen. How much will customers be willing to spend? There are still many open questions and it is probably linked to how good the customer experience will be. Margins are directly linked to the manufacturing costs and pricing power and it will be interesting to see how high they will ultimately be. Financial risks will also increase if Lilium experiences any setbacks in the certification process.

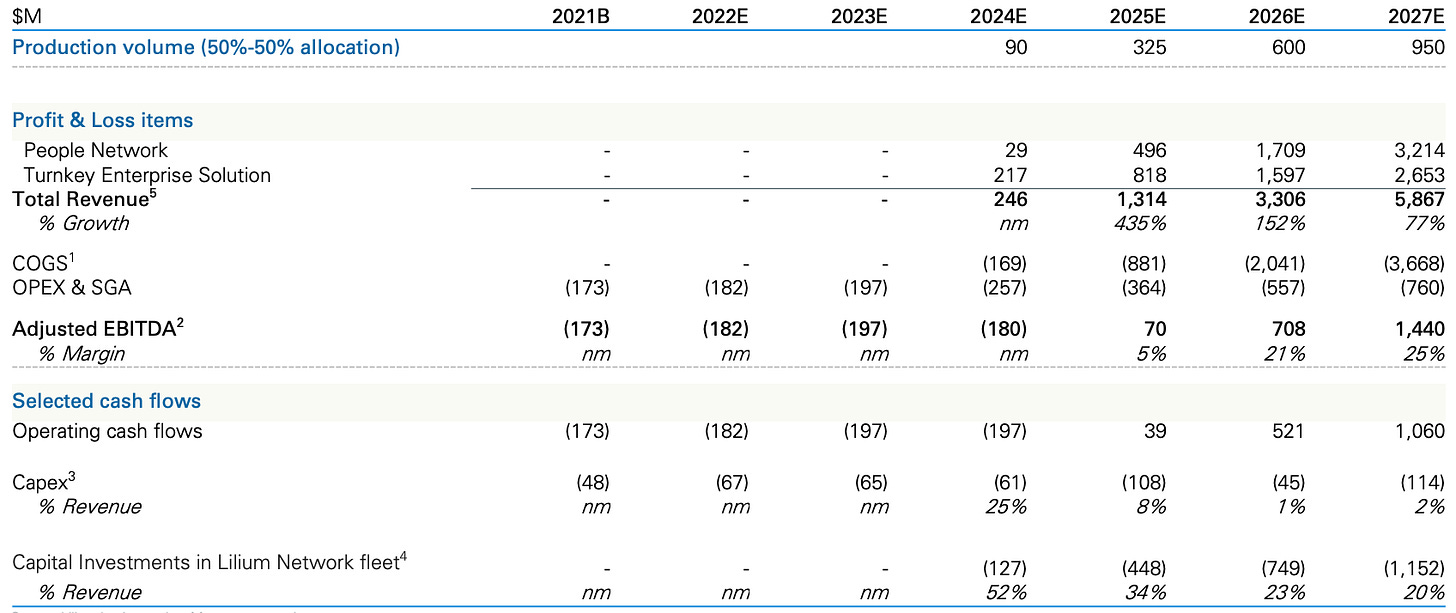

12. Financials

One thing I want to clarify is that Lilium is not at the typical stage you would expect from a public company. Lilium has a great product but is not generating revenues yet. An investment case should be compared to start-up investments and should not be compared to regular stock market investments.

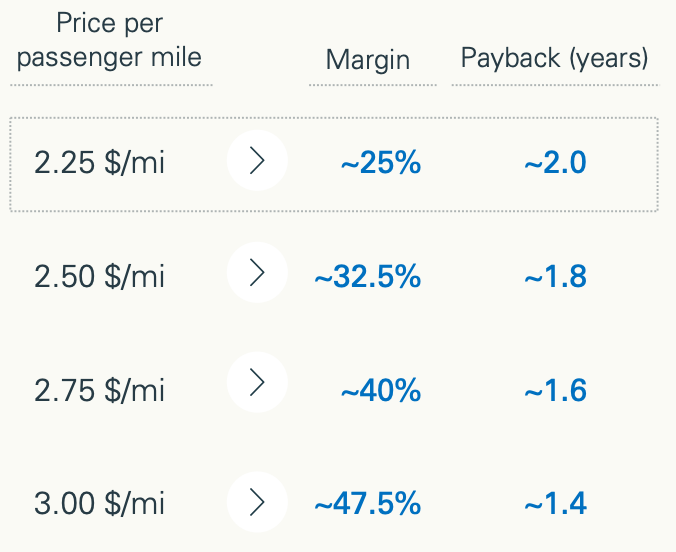

Pricing of flights

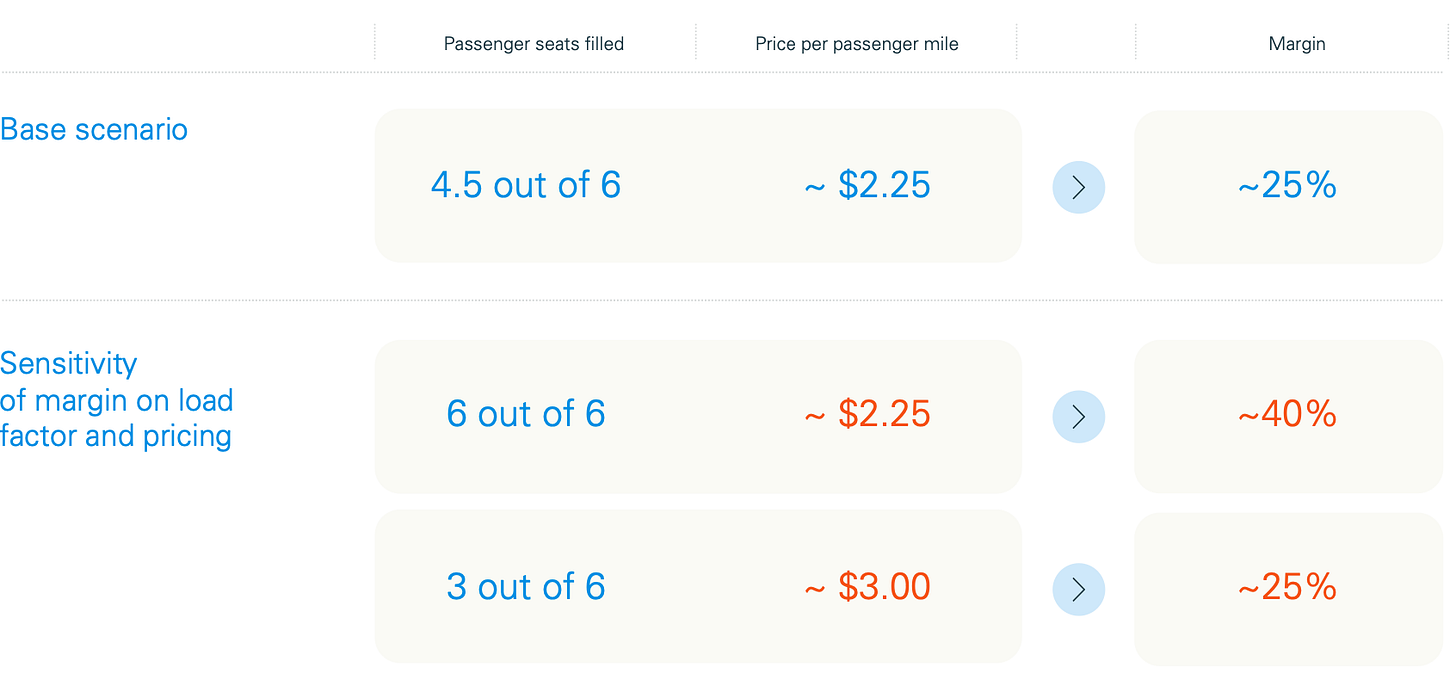

The goal for Lilium flights is to save time but still keep it affordable so it is not limited to very wealthy people. The pricing is expected to be between $2.25 to $3 per passenger mile which would correspond to margins between 25% and 50% depending on how high the pricing power will be. This price is cheaper than using a taxi with all the additional benefits explained earlier.

However, when filling 6 out of 6 seats at the conservative price of $2.25 that would increase the margin to 40%:

Most competitors have up to 4 seats instead of 6-7 with Lilium jets which gives Lilium the advantage of being able to split up the costs between more passengers and offer a more competitive price.

Expected revenues

In the beginning, Turnkey Enterprise Solutions will account for a higher portion of revenues because they expect that building up a strong brand in the Lilium Network is going to take some time but will result in exponential growth in the end.

13. Conclusion/own thoughts

When investing in start-ups or very early-stage companies management and the product/service are the most important two variables. Both of these are exceptionally good at Lilium which is the main reason I own shares. There is a path for Lilium to succeed but only time will tell if they make it. I expect governments to further subsidize emission-free transportation since it is evident to reach emission goals. Lilium will be in a prime position to benefit from that. The reason why I invest in growth stocks is that I love studying innovative companies that do not shy away from big challenges. Lilium might have chosen the biggest challenge I have ever seen. Now it comes down to whether I believe Lilium has a chance to achieve their vision. My honest opinion is that if any company will be able to achieve it, it will be Lilium. It is still by far my riskiest position and please do not invest money you can not afford to lose because the risk is definitely there. I am a proud shareholder of Lilium and can not wait to see how this story will play out. Whether they will succeed or not - it will be an interesting journey for me as a shareholder regardless.

Wishing you guys all the best, Alessandro

Disclosure: I have a beneficial long position in the shares of Lilium either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial advisor and investment decisions should not be made solely based on my article. Please do your own due diligence.