Small Cap Lab on Kambi Group

Deep dive on Kambi Group

Welcome, it’s great to have you back! If you aren’t a subscriber yet and enjoy the content I post, feel free to subscribe and you won’t miss any new content.

Today I will present you my deep dive on the leading sportsbook provider for online sports betting: Kambi Group.

1. Introduction

Kambi Group was founded as a spin-off by Unibet Group in 2010. They partnered with 888, one of the leading sports betting operators, in 2013 and went public via IPO in 2014. Furthermore, they were named among Europe’s fastest growing companies in the Financial Times in 2017. Kambi has offices in seven locations including London, Malta, Philadelphia, and Stockholm, and more than 850 employees. The mission of Kambi is to provide a scalable, high-quality sportsbook product at a fair price for the operators.

2. Global sports betting market

The data and intelligence firm H2 Gambling Capital (H2GC) projects very strong growth in the online betting market. Sports betting is growing more quickly than every other betting sector. H2GC also expects sports betting with horse racing excluded to grow from €30.3 billion to €58.6 billion between 2020 and 2025 which represents a CAGR (compound annual growth rate) of 14.1% which is the highest CAGR of any betting and gaming vertical.

3. Kambi’s role in this market

Kambi brings a platform to the sports betting market which includes services like odds-compiling, risk management, and many more. The platform is run on an in-house developed software and Kambi’s technology provides a blank canvas that can be used to design the products according to the specific needs of customers. Operators can use the platform to run their software and user interface on that platform while having the opportunity to adjust their user interface making it appealing to their customers as well.

There are many compliance issues and questions arising in a highly regulated industry and Kambi brings a lot of experience and expertise to its partners. Regulations and laws are becoming more complex and Kambi provides software that can be adjusted to local requirements and the expertise to adjust it accordingly. The service offered by Kambi as a sportsbook platform needs to be highly scalable and the differentiation needs aren’t as high as in marketing for example.

4. Business model

One aspect that makes Kambi’s business model truly outstanding is that they don’t compete with all the operators which is a highly competitive market with low differentiation in quality and therefore low margins as the operators need to differentiate by a cheaper price for consumers respectively better odds for consumers. Instead, they offer the software and platform all operators need to run their business so it doesn’t matter which operator will ultimately gain the most market share because Kambi is making money by the growth of the entire market. Kambi operates in a revenue-sharing model and makes money when the operators are making money (similar business model to Evolution Gaming). They charge a fixed fee and additional fees based on different variables like the number of bets, revenue generated by the bets, etc. This leads to similar interests for Kambi and the operators and Kambi not having to compete in the highly competitive sports betting market.

Kambi collects real-time data every day and is able to continually enhance the algorithmic trading models for all customers by incorporating the new data collected at a specific customer. With every new partnership, the network of Kambi grows, and more data gets collected which can be used to improve the product. Moreover, risk management also compiles the odds accordingly to the real-time data. Using all the data collected from different operators, Kambi is able to advise its customers on marketing campaigns as well.

Once Kambi has a partnership in a specific region they can use their expertise to offer a product that fits the regulations in that country to other customers too.

The scalability of the platform is very high because most operators use similar software and the number of users is independent of the service that Kambi provides. The costs of gaining new customers are very low because Kambi doesn’t need to program a new platform for every new customer.

Kambi is already settling more than 500,000,000 transactions every month and 5,000,000-10,000,000 bets around the world every day.

5. Kambi’s strategy

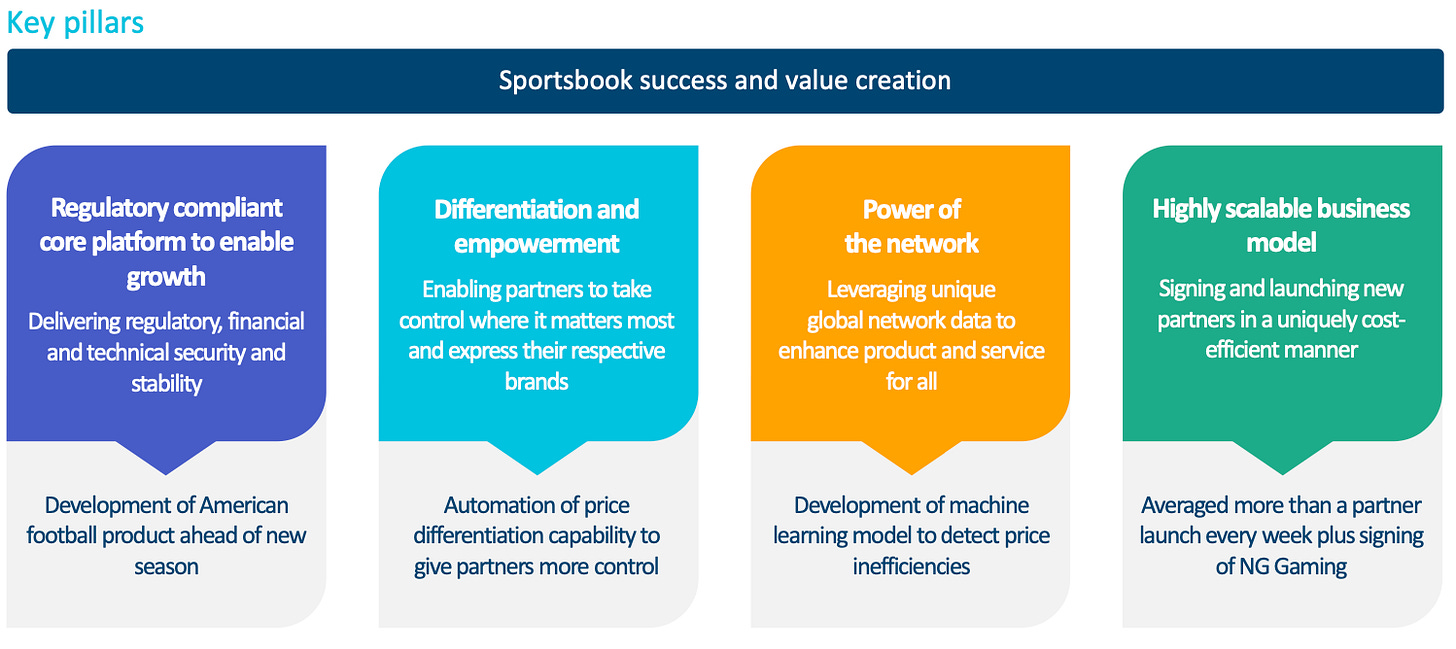

At the last Capital Markets Day, Kambi presented the four key strategic pillars which are the most important drivers of growth and success for the upcoming months.

1) Regulatory compliant core platform to enable growth

Consumers want to create their own bets by combining different games and bets within one game in one parlay. Kambi will provide this opportunity to consumers by the start of the new NFL season for the first time this year. Parlay betting is key to more revenue and e.g. in New Jersey, approximately 50% of revenue is generated by parlay betting.

2) Differentiation and empowerment - enabling partners to take control where it matters most and express their respective brands

There are so many different operators on the market and it’s important for every operator to differentiate at least a bit and express their specific brands. Although are operators have a similar business model they still offer slightly different services and brands to the consumer. Operators using Kambi’s business model can also decide to adjust the odds to decide on how competitive they want to be at a specific game or event.

3) Power of network - leveraging unique global network data

Kambi is able to generate data from every operator and use that data to improve the service that is currently offered to Kambi’s partners. Furthermore, operators looking for a software provider are more likely to partner with Kambi because of the experience and insights Kambi has in the market.

4) Highly scalable business model

The rapid expansion in Latin America is also caused by the easily scalable business model of Kambi because Kambi is gaining more insights into the LATAM market with every new partner. Olimpo.bet was launched in Peru before the start of the Copa America on June 1st and Brazil is expected to be opened up to regulatory sports betting next year. More on the LATAM market later.

6. Kambi in the US

Kambi is currently active in 14 different states. Sports betting is live in about 20 states and the US sports wagering sector earned almost $1.5 billion of revenue in 2020 which was up over 60% compared to 2019 although many sports events were postponed or canceled. VIXIO GamblingCompliance expects revenue of the US sports wagering sector to be at around $10 billion by 2025 which is definitely not unrealistic when including the ongoing regulations in the US. Kambi is the leading sportsbook provider in the US and launched 39 sportsbooks in 2020. E.g., Kambi is powering the launch of Penn National Gaming’s Barstool Sportsbook with more than 66m monthly visits. Penn National wants to capitalize on the ongoing regulations in the US and uses Kambi’s technology to do so.

Regulations differ from every state which means that companies need to get an adjusted product in every state. Regulated sports betting in the US is just getting started and there are many states expected to start sports betting later in 2021.

Regulatory updates:

New York State

The regulator opened the window for applications for mobile sports betting platforms on July 9th and at least two platform providers will be awarded the opportunity to launch mobile sports betting. This process is expected to take less than 5 months.

Florida

In May 2021 regulators approved a compact between the state and the Seminole Tribe which left the Tribe with a sports betting monopoly. Everyone with interests in the sports betting market besides the tribe is challenging the compact in court and starting a new initiative to legalize regulated sports betting in 2022.

California

The situation in California is similar to Florida as a coalition of tribes has been provided the opportunity to legalize sports betting at tribal casinos. If other parties with interests will be able to profit from the latest updates is left to been seen.

7. Kambi in Latin America

The population in LATAM of approx. 650m provides so much potential for the sports betting industry. Sports play a very important role in LATAM culture and almost everyone engages in sports especially soccer.

Kambi has market leadership in Columbia which was one of the first countries to legalize regulated sports betting. There is progress to legalize operational online sports betting in Brazil which would be one of the biggest markets in the world. Kambi is in a prime position to benefit from that as soon as it’s done and other notable countries that either provide regulated sports betting already or are in the progress of doing so are Mexico, Peru, and Chile.

Kambi is making significant progress in Latin America like I highlighted earlier when talking about the company’s strategy and as soon as regulations created a framework in which an industry can grow, I am confident that a solid share of revenue of Kambi will be generated in Latin America.

8. Geographical strategy

The geographical distribution of revenue perfectly represents the strategy of a company coming from Europe and expanding in the US. The share of revenue coming from Europe is slowly decreasing which isn’t due to the actual revenue decreasing but the growth in America is so high that the relative share is decreasing.

America is the biggest sports betting market in the world and with more and more states legalizing sports betting the growth of the sports betting market in America isn’t expected to slow down.

9. CEO / Management

Kristian Nylén is the CEO of Kambi and is employed by Kambi since 2010. Before becoming the CEO of Kambi, Kristian led the entire sportsbook operation of Unibet and was part of the management team. He holds 720,000 shares and 100,000 options.

Anders Ström is the Chairman of the Nomination Committee and a member of the Remuneration Committee. He founded Unibet Group plc in 1997 and was the co-founder of Kambi in 2010. He holds 5,428,564 shares in the company.

The entire management team and board of directors hold shares in the company which creates similar interest within the management and the shareholders.

10. Risks

Regulations

The entire business of Kambi is reliant on regulations and political decisions and court rulings influence the business significantly. Decisions regarding regulations can have a positive or negative impact on the business but the trend over the last couple of years has shown a clear path towards more legalized sports betting.

Match fixing

The term match fixing is used for manipulated games and events where the participants make money off the manipulated result. Risk management plays an important role in trying to identify manipulated matches because the compiled odds can’t incorporate manipulation. The majority of revenue however is generated in most public leagues which have a lower chance of match fixing than unpopular leagues.

Dependency on most important operators

A high proportion of revenue is generated by a few large customers and a loss of business with any of these could have a significant impact on the business of Kambi. Furthermore, a large customer is also more likely to start an in-house sportsbook.

Customers starting an in-house sportsbook

One example is DraftKings who merged with SBTech (a competitor of Kambi) and started an in-house sportsbook and therefore left Kambi as a customer. However, most of the customers of SBTech left and joined Kambi because they are independent.

11. Financials

When comparing the earnings of the second quarter of 2021 to the second quarter of 2020 one needs to keep in mind that almost all big games and tournaments were canceled in the second quarter of 2020 due to Covid.

However, earnings reported on July 23rd last Friday were still very strong: Kambi was able to generate €42.8 million in revenue in the second quarter of 2021 which equals an increase of 189% compared to Q2 of 2020. The operating result (EBIT) was €16.6 million (-3.4 in Q2/2020) at a margin of 38.8% (-22.7%). Earnings per share were €0.432 (-0.099).

The earnings were boosted by the Euro 2020 soccer tournament and the NBA playoffs happening in the second quarter. Furthermore, the ongoing expansion in the US was beneficial to the earnings and the full impact will become visible in the annual report 2021 which will include most American leagues’ regular seasons (NFL, NBA, etc.).

Valuation

Kambi is currently trading at 7x EV/Sales and at a P/E ratio of 28. A comparison to its peers is very difficult because there are no publicly traded competitors. When trying to compare the valuation to other companies in the betting industry, Kambi is very fairly valued.

12. Summary

Kambi is the leading sportsbook provider in an industry that is growing quickly. The trend over the last years has shown that more and more countries are legalizing regulated sports betting. Kambi is in a prime position to benefit from the ongoing regulations because they already have partners in all major sports betting industries. The shared revenue model provides the opportunity for Kambi to benefit from the growth of the entire industry instead of having to compete against the operators. Financials and valuation both support the investment thesis. If the opportunities outweigh the mainly regulatory risks depends on the individual strategy and opinion of every investor.

If you enjoyed the deep dive, feel free to share the post, subscribe, and leave a comment / like. Have a great week!

All the best,

Alessandro

"A comparison to its peers is very difficult because there are no publicly traded competitors." What about Genius (GENI)? Thanks.