Being able to program DNA like it is code - sounds impossible right? Let me tell you about the most disruptive company I have ever seen and why everyone should know about it.

1) What if we could grow everything?

DNA can also be seen as digital code which is made up of A’s, T’s, C’s, and G’s. Ginkgo takes on the challenge to read and write it to program cells like they are computers. Cells can read the code and do the things they are assigned to do. Ginkgo can read the code with DNA sequencing and write and change it with DNA synthesis. Like I highlighted in my thread last week, the cost of DNA sequencing has significantly decreased over the last couple of years which benefitted Ginkgo.

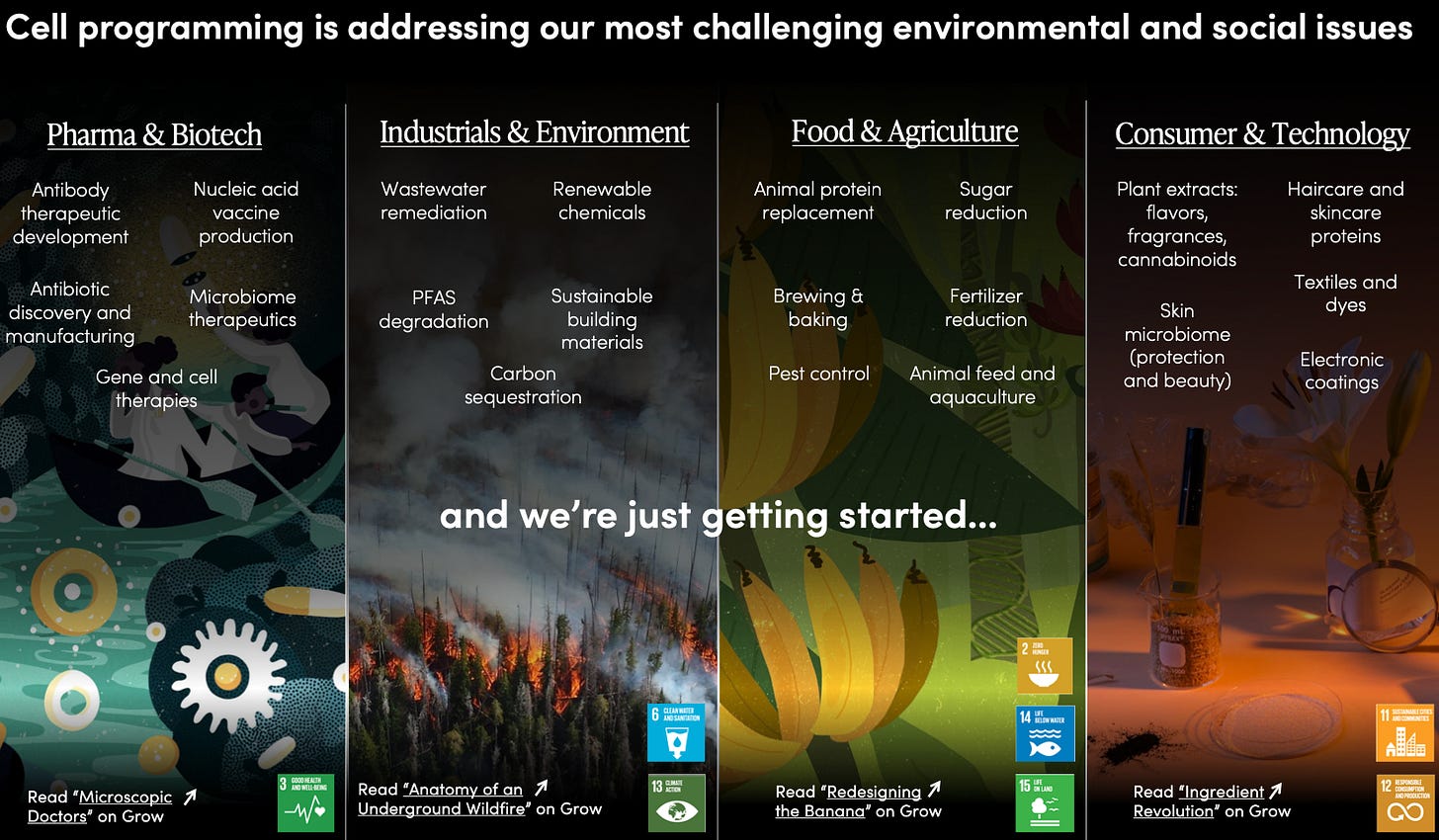

2) Importance of cell programming

The use cases of cell programming are unlimited and there are new opportunities emerging every day. Some of the most underrated applications are in agriculture as food can now be adapted exactly to the individual requirements (heat resistance, more nutrients, etc.). This is increasingly important as climate change is already impacting agriculture and the situation isn’t expected to get better soon.

The effect in pharma and biotech is obvious as cell programming and gene editing are transforming biotech like no other technology.

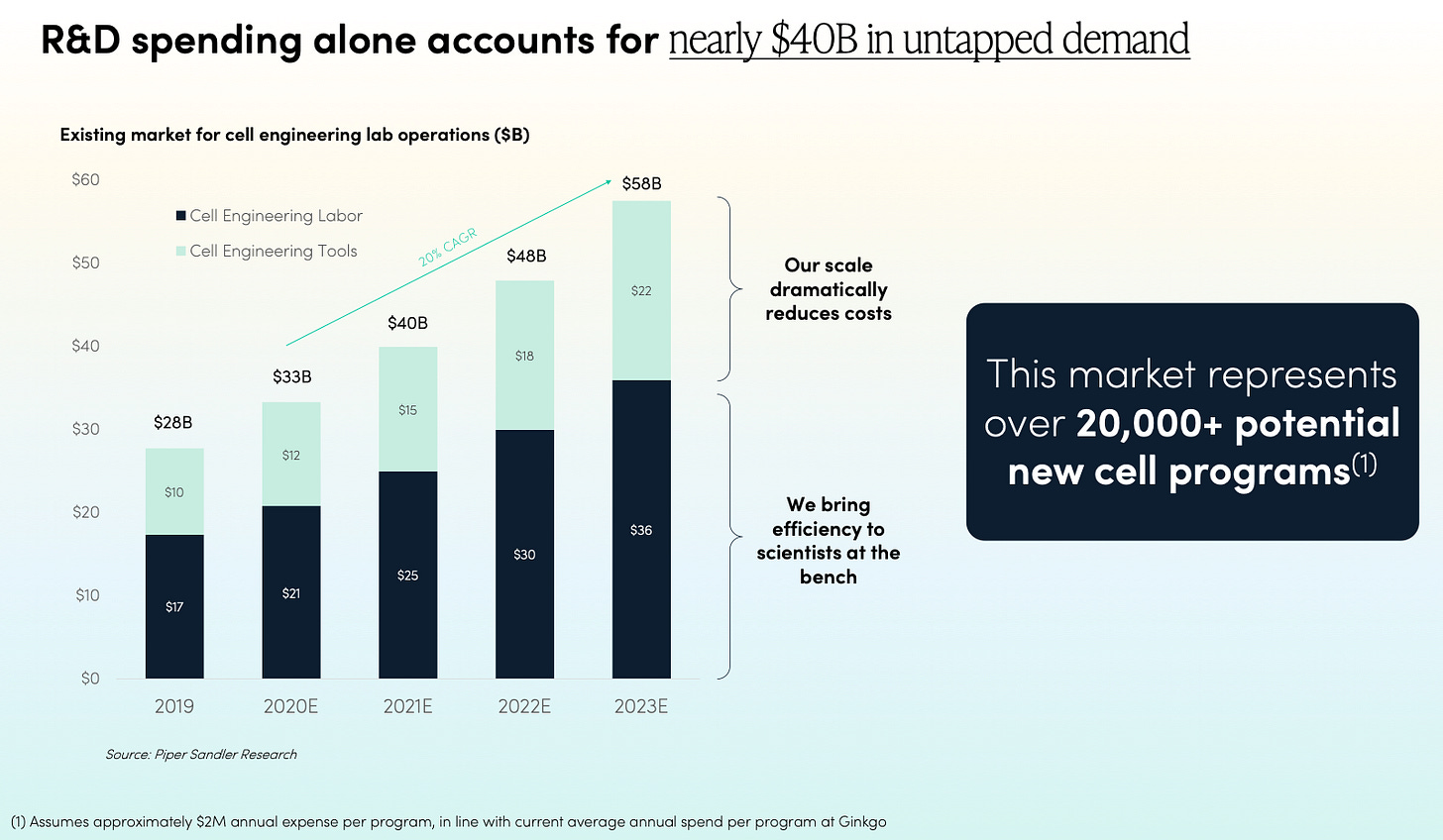

3) Cell programming industry

R&D (Research & Development) spending has increased significantly over the last couple of years as more companies realize the endless potential and wanting to develop products in this industry. This benefits Ginkgo’s Platform-as-a-Service business model (more on that later).

4) What is Ginkgo exactly doing?

After clarifying the importance of cell programming, I want to specify the role of Ginkgo in this industry. Ginkgo developed a platform that is used to program cells for their customers so the customers can develop their products using that code.

5) Ginkgo’s platform – Foundries

Living organisms replace classic factories in biological engineering. The challenge for Ginkgo is designing the optimal organisms which is done in their bioworks foundries. The foundries are combining data analysis, software, and biology and create the opportunity to scale bioengineering.

6) Ginkgo’s Platform - Codebase

The codebase can be compared to a library of code that software engineers use to program but instead of algorithms, bioengineers can benefit from the existing organic structures in the codebase. The codebase is constantly growing as the foundries are producing new cells every day.

7) Scaling

With an increasing number of programs run on the platform, Ginkgo can lower the cost for new programs which attracts more customers which again leads to more programs.

The programs that have been run on the platform are also diversified over many different industries which benefits Ginkgo because they can more easily grow in every sector after successfully running programs from that industry.

8) Unique Business Model

Once a program is set to begin, Ginkgo receives an upfront payment to cover the R&D costs which leads to highly predictable revenue streams. On top of that, Ginkgo also receives downstream value via equity or royalty stream on the successfully completed program. Additionally, once the program is done Ginkgo has almost zero expenses, so the contribution margin is close to 100% on these downstream revenue streams.

9) Projections

Their projections are very optimistic but with exponential growth and a favorable business model, it is definitely not unrealistic. The revenue growth is expected to be around 100% every year for the upcoming 5 years which includes exponential growth.

10) CEO / Management

The management team is immensely important for a young company. Ginkgo is led by the founding team which is great. Jason Kelly is the CEO of Ginkgo and makes a very ambitious impression and even more importantly, his drive and fascination for biological engineering can be seen in every interview. Another person I want to highlight is Tom Knight. He is also known as the godfather of synthetic biology and worked as a scientist at MIT for most of his life. He is part of the founding team and plays an important role for Ginkgo. Ginkgo goes public via SPAC with Soaring Eagle ($SRNG) and they plan to have the transaction completed by the end of Q3/2021.

11) Risks

Ginkgo is working in a field that is still developing and a very young company. The company is also unprofitable which leads to some risks that the expected revenue streams and profits can not be achieved. The valuation based on the current financials is very high and the financial projections are highly ambitious.

12) Summary

Ginkgo Bioworks is one of the most disruptive companies in the world and could transform biotech like no other company. They are building a platform that can be used by their customers to develop products in the field of cell programming. The business model is easily scalable and grows with the growth of the whole sector. Whether the opportunities outweigh the risks depends on the individual strategy of each investor. For me personally, Ginkgo is a top 5 position in my portfolio and I am looking forward to the fascinating future of this company.

This is my first publication on Substack and I hope you enjoyed it. Feel free to subscribe and share the post if you liked it. See you soon!